Stock Market Investing 101

Robert Kiyosaki, the author of possibly the most bought personal finance book of all time, "Rich Dad, Poor Dad," famously says…

“The reason the poor and the middle classes struggle

is that they buy liabilities that they think are assets.”

And what do I keep going on and on about?

ASSETS

BIG JUICY ASSETS.

Only assets can create your freedom.

And if we want freedom, we need to be filling our lives with loads of juicy ASSETS.

There are 4 primary asset classes and this video goes deeper into my first asset love - investing in the Stock Market, also called Equities.

Click here to watch the video.

WHAT ARE ASSETS?

There are different kinds of assets you need working for you and you must become an asset lover in order to be free. Unfortunately, as Robert says, most people think things like their home, their car, a yacht, the holiday timeshare, the expensive schooling for the kids… are assets.

BREAKING NEWS - they are NOT ASSETS. They are huge liabilities.

Liabilities drain and deplete your wealth because all of the available money

you have is spent either paying for them or maintaining them.

It’s so important to know what an asset is.

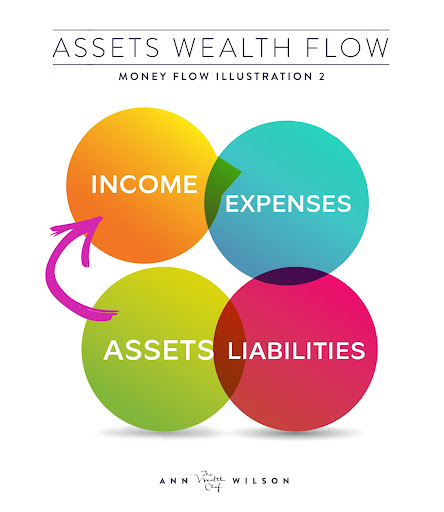

Robert describes an asset as something that puts money back into your life just like this picture shows.

If you haven’t yet read The Wealth chef Book, get your copy NOW as it explains this all in way more detail.

There are different types of assets too - these are called asset classes.

The first asset class is paper assets, also called intangible assets. The most common of these are stocks and shares also known as equities.

The second asset class is tangible assets, and the most common asset type in this class is investment property.

The third asset class is low-input businesses.

In this article I’m diving deeper into the stock market, stocks and shares - also called Equities.

Stock Market Investing Fundamentals

What is a share? What is a stock?

There are amazing businesses all around the world that you and I can own. YES, you and I can be a shareholder of a whole array of amazing companies around the world by owning shares or stock in that company.

When I'm talking about investing in the stock market, generally we're talking about publicly listed companies.

A company will decide to raise finance for the company so it can grow by “listing on a stock exchange” thereby offering a number of shares in that company to the public.

The company becomes publicly listed and the likes of you and I can buy and own a bit of that company.

Your big institutions, pension funds, the retirement funds and the like also buy these shares and they are called institutional investors.

When you think about it, when you invest in a company via the stock market, you're actually becoming a business owner. You own a share in great companies and you can do so via very straightforward, simple mechanisms such as index tracker funds.

Via a fund you own a slice of hundreds of great companies all around the world. From the US to China to India to the UK to Africa, South America, and Australasia - you can own the developed world, the emerging world, and even focus on ethical investing only - all from the comfort of your home.

Investing in the stock market and owning shares in great companies is a super, super, super sexy asset class.

By owning a slice of a business by being a shareholder, you benefit through both the income and the profit that company makes and by the growth in the value of the company.

Assets create wealth for you in two ways,

through income and capital growth.

The income you get from owning shares is called dividends.

Dividends are paid out where companies have made a profit and they choose to distribute that profit to their shareholders in the form of dividends.

If you look at the fund fact sheet of the index tracker funds you are investing in or if you look at a company prospectus, you can see what the current dividend yield is.

The dividend yield tells you what income those shares are generating.

There are also different kinds of shares you can own.

Private stock or private shares is when you own shares in a non-listed or private company. If somebody owns a company that is not listed on a stock exchange and they sell some shares in it to somebody else, that is a private deal.

Private equity deals can be very lucrative but they also tend to be far less liquid (harder to buy and sell) because you've got a smaller pool of people who you can sell those shares to.

Within listed or public company shares, you also get two other forms of shares - common stocks and preference or preferred shares.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does and common stockholders have the right to collect dividends. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

You can invest in an index fund that includes only preference shares or preferred stock and this generally gives you higher liquidity. When comparing the overall return between preference shares and common stock, common stock tends to have a higher historical growth or return on investment over time.

How do stocks trade?

Publicly listed stocks are traded (bought and sold) on stock exchanges, also called stock markets.

A stock market is like a farmers market.

Imagine going off to your local farmers market and farmers have brought their produce from all over and you can buy some tomatoes, some bananas, some beautiful cabbages and the marketplace is where you buy that.

The marketplace doesn't own that produce, it's just a place where the produce from the farmers can be exchanged for your money.

At the Stock Market, that product is the share in a company.

There are actually physical exchanges around the world.

Some of the most well-known ones are:

- The New York Exchange where you have that big statue of the bull and the bear in front of it.

- The London Stock Exchange which is called the FTSE.

- The DAC in France

- The Hang Seng in Hong Kong

- The JSE in Johannesburg

- The ASX in Australia, and so on.

Nowadays very little trading actually happens on the stock market floor, like you see in the movies with men in weird coats waving pieces of paper around. Most trading happens digitally.

In addition to those exchanges, you also have something called over-the-counter exchanges.

The NASDAQ is the biggest over-the-counter exchange where technology shares are listed, bought and sold.

If something is listed on the stock exchange, that just tells us which exchange those particular shares can be bought and sold at.

Some very big companies are listed on more than one exchange.

Medium to smaller companies would only typically be listed on one stock exchange.

With an online brokerage, we aren’t too concerned about what exchange a company is listed on because, thanks to the internet, you can generally buy shares on any of the main exchanges around the world from your one online broker.

What is a stock broker and why do you need one?

Stocks and shares are bought and sold at the stock market but you need somebody to facilitate the exchange, and that is where the Stock Broker comes in.

Imagine at the farmers market, you could use a trust mechanism where the bananas are left on a table with a price and you take your bananas and put your money in an honesty box. The exchange has happened based on trust.

Usually that isn’t the case and there's somebody at the market stall to facilitate the exchange and in the stock market world that person/ entity is called the stock broker.

In the bad old days where stock market investing was the exclusive realm of the rich and connected, this Stock Broker was an actual physical person.

If you wanted to invest in shares you had to speak to an actual person (mind blowing I know) and tell them - “I want to buy this amount of stock in these companies” .

They would then take their cigar, call around the market to see who wanted to sell their shares and at what price, they would haggle a bit, facilitate the exchange and take a commission for doing it all.

It’s like in real estate, you have a conveyancer or an escrow agent that facilitates the exchange and makes sure that it's all fair, the asset exchanged is real and valid, and nobody cheats anybody.

Then along came this amazing thing called the internet and freed stock

market investing and made it available to you and me!

Stock Market Investing is the first asset class that technology completely transformed because now computers have become our stock brokers and they facilitate the exchange.

And with it, the birth of Online Brokers and massively reduced costs and low barriers to entry.

Online broker platforms, sometimes called discount brokerage platforms act as the exchange.

You can go onto your online broker platform and buy X number of units in Y index tracker fund or in a specific company at the click of a button from anywhere in the world.

You place your offer, called your bid, and the computer links it up with other people who are saying they want to sell their units and it matches the two and VOILA! you've got an offer (to sell) and a bid (to purchase). The computer does the exchange, and ensures all ownership registers etc are updated - and on you go with your life.

What makes the price of the stocks change?

Over the longer term, the price of a stock changes based on the value of those underlying assets.

- How successful are those companies?

- Are they able to grow their earnings?

- Are they able to utilise their capital well?

- Do they have sustainability?

The long-term trend of share prices of an individual company will typically be based on their performance, their ability to give a higher return on investment for shareholders and grow in value.

But in the short term it’s all CRAZY EMOTIONS!

The movement of stock market prices is based on supply and demand, largely dictated by emotive reactions to happenings and news in the world.

Short term movements in the market

are totally illogical and are best ignored!

Ann Wilson

It is REALLY, REALLY, REALLY important you don't let the drama driven ups and downs of the market bother you.

As an investor, you're interested in owning the underlying companies and you don't give a damn about the ups and downs of the daily price changes or the weekly price changes or the monthly price changes!

This is why it is so important you put in place a regular investment strategy where you invest in a simple portfolio of diversified Index Tracker funds EVERY month, benefiting from something called cost averaging.

Join me on my FREE training to discover the 7 steps to creating your freedom and learn how to become a Savvy Investor using these fabulous investments called Index trackers and low-cost digital investment platforms. Go here to secure your spot.

Don't let the ups and downs of the market scare the bejeezus out of you and keep you from your wealth.

A quick question for you…

- are you already a stock market investor?

Spoiler alert.

If you have any kind of retirement funding, savings, pension, 401k, IRA, Superannuation, RA, if you invest in any kind of mutual funds or unit trusts, you are a stock market investor.

So perhaps a better question to ask is:

- Are you a Savvy Investor who knows what they are invested in, how their investments are performing, what fees they are being charged and how much their investments will be worth when they are ready to stop working?

If you can’t say a resounding YES I’m a Savvy Investor, then join me on this free training and get Savvy.

Remember - Assets create your freedom, not you.

But you are the one that needs to get those assets working hard for you.

So until next time, enjoy being a savvy asset lover.

Big love